Gold And Silver: Newton's Third Law Is About Ready To [Over] React

Michael Noonan | Jul 28, 2013 05:35AM ET

Our clarion call is for the physical market to soon takeover the actual price for buying and selling. When, we do not know? Timing is now less critical than actual possession, from this point forward.

The probability of a new low, in futures, may be 50-50. It was much higher a month ago. The odds of successfully picking a bottom are remote. Not to pick on Richard Dennis, but he is a poster boy for losing big time when he tried to pick a bottom in sugar, to the extent of decimating one or a few of his funds. How hard could it have been to lose so much money buying sugar when it was under 5 cents, at the time?

The point is, never think you know more about the market than the market itself. It is for that reason we always say to follow the market's lead. Too many try to get ahead of it, speculating that it will catch up to one's brilliant "market timing." Margin departments are usually the first ones to let the ego-driven speculators know that their [questionable] prescience has gotten a little more expensive, in the process.

The odds of being able to buy physical gold and silver, at current levels, diminish with each passing month. In terms of pricing for buying physical precious metals, [PMs], we are more than likely looking at the lows. The timing for buying and holding as much gold and silver as you can will not be much better than at current prices for a few generations. If anyone wants to pick a bottom in physical gold and silver, the odds are against them.

If silver were to go to $140 the ounce, will it matter if you paid $20 or $24? Same for gold.

Here is how we see it.

If there is one law that is not on any known government's books, but one which none of them can avoid, it is Newton's Third Law of Motion: To every action there is always an equal and opposite reaction. All government, Keynesian, and central planner idiots abuse this law profusely, and at the expense of the masses, throughout history. Every once and awhile, it catches up to them, and we stand fortunate enough to be the beneficiaries for decades suppressed prices.

Decades, we say, and not just since the 2011 highs. The New World Order, [NWO] has had marching orders for their central bankers to keep gold prices low, especially since the United States was placed into their receivership hands by Socialist Franklin Delano Roosevelt, in 1933. Price has been steadily rising, ever since, with a few upside bursts that the NWO has tried to contain. That is about to come to an end.

The fiat game has run its course. [We covered the ruse of Federal Reserve Notes, [FRNS], in our commentary , click on the second chart.

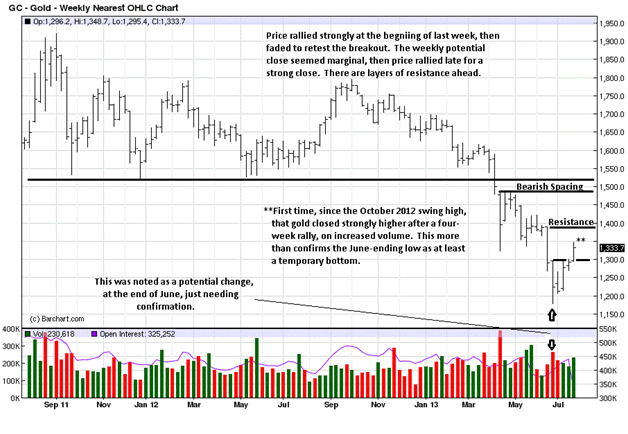

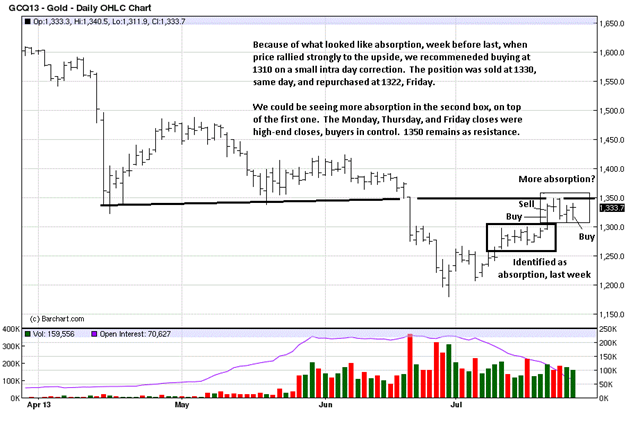

Last week's call for buyers absorbing the effort of sellers, just under 1300, was spot on. Once price rallied above that area, it did so on strength not seen for some time in the gold market. We recommended buying, as stated in the chart comments.

It is possible that another level of absorption may be forming, in the second box. Price activity will confirm or negate that, possibly next week.

The argument for silver is not as compelling, chartwise, as explained.

It looked like silver was signaling earlier than gold, in the past month, and note was made of its high volume, strong close, at the end of June, similar to gold, in the article above, fourth chart, making several observations about it.

Will gold pull silver up, or will silver act as a drag on the current rally in gold? Each has to be viewed separately for decision-making purposes. Right now gold is favored, and it would be a mistake to buy silver over gold in the hopes it will catch up. Buy silver futures when developing market activity signals a buy, as occurred in gold.

The window of opportunity to buy physical gold and silver continues to narrow. Like the housing market top was known to be coming, when it came, those who waited too long regretted it. When the bottom for the physical PMs is known as a certainty, those who waited for a "better price" may also regret that decision. It is all about choice.

We choose now for buying and holding physical gold and silver. We are on the long side in gold futures, but that can change on any given day.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.